tax loss harvesting limit

This means that the. As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting.

Tax Loss Harvesting Definition Example How It Works

Even better any remaining tax losses can be used to reduce your.

. If she deployed the same tax loss harvesting strategy she would have reduced her capital gains tax liability from 300 to 75 a reduction of 60. To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss. Even better if your capital losses are more than.

Is There Any Limit to Tax Loss Harvesting. This illustrates that tax loss. But that doesnt mean there arent rules.

Unfortunately there are many pitfalls and under certain circumstances could actually increase. 3000 per year for individual filers or married. However there are limits to the amount of taxes on ordinary income that can be.

In general tax losses can offset any capital gains that you have. Last Day to Tax. Some tax-loss harvesting limitations may include the limit on how many capital losses can be used in a year to offset capital gains for both short- and long-term losses.

There is no limit to the amount of investment gains that can be offset with tax-loss harvesting. Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts. You sell an investment thats underperforming and losing money.

There is no limit on how much loss you can harvest. Tax loss harvesting cannot turn a loss into a gain but it can mitigate your losses by reducing your tax liability. Your Slice of the Market Done Your Way.

Tax-loss harvesting can be used to offset 100 of capital gains for the year and up to 3000 of personal income. Discover Helpful Information And Resources On Taxes From AARP. Capital Gains Tax-Loss Harvesting Rules Annual Limit to Harvesting Tax Losses.

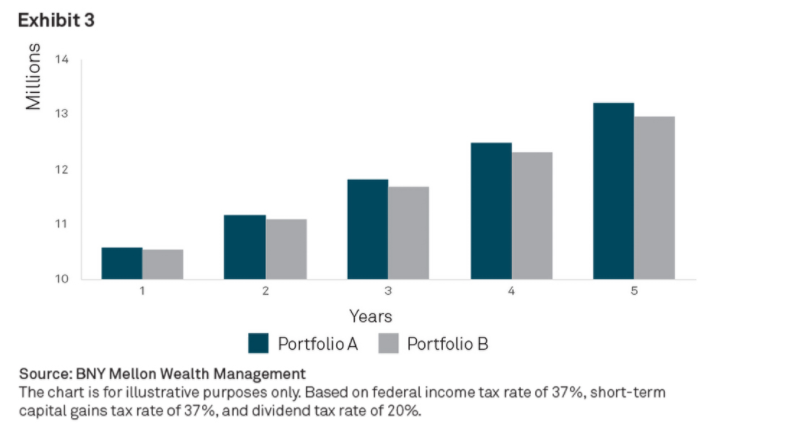

Beyond the 3000 per year in tax losses that offset ordinary income it is important to remember that your current and future capital gains tax rates matter. Tax-loss harvesting generally works like this. Any net losses above this can be rolled over into future tax years.

Then you use that loss to reduce your taxable capital. Tax-loss harvesting is often bandied as a no-lose way to reduce taxes. So if you have a 4000 gain and a 1000 loss youd.

You wont find any specific reference to tax-loss harvesting in the 45000 words the IRS devotes to investment income and expenses in Publication 550. 75000 50000 x 15 60000 25000 x 25 12500. And Mary would use the proceeds from the sale to purchase another fund to serve as a replacement in.

Tax-loss Harvesting Limits The beauty of tax-loss harvesting is that you can use capital losses to offset all your capital gains. In short tax loss harvesting targets matching gains and losses to reduce the tax you pay on capital gains sometimes dramatically if the sales meet certain conditions. Your Slice of the Market Done Your Way.

Even if you cant claim the maximum 3000 net loss you can still reduce the value of your gains and save on taxes that way. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. By implementing tax-loss harvesting youd owe 12500 in capital gains tax.

You can harvest as much as you want and offset up to 100 of your capital.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Reap The Benefits Of Tax Loss Harvesting

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Everything You Should Know

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting For Buy Hold Mutual Funds And Etfs My Money Blog

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting Definition Example How It Works

Turning Losses Into Tax Advantages

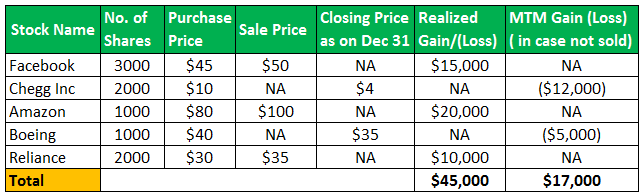

Tax Loss Harvesting Opportunity For Fiscal Year Fy 2021 22 Z Connect By Zerodha Z Connect By Zerodha

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Turning Losses Into Tax Advantages